Striving to be your trusted partner in Digital

Asset Management

Trezor provides unique exposure to digital assets through multiple strategies registered with the US Securities & Exchange Commission as an investment adviser

Participate in one of the highest performing asset classes of the past decade*

Trezor provides unique exposure to digital assets through multiple strategies registered with the US Securities & Exchange Commission as an investment adviser

Approximately $1,000,000,000

Assets Under Management

Trezor Digital Trades, a regulated digital assset manager with over $1 Billion of Assets Under Management.

Learn more about our current status incuding AUM at www.adviserinfo.sec.gov

WE WON

TADS AWARD

Worlds first international awards for tokenized assets and digitized securities

Index Fund

Trezor Select 5 Digital Fund provides exposure to one of the best performing asset classes of the last 5 years

Income Fund

Trezor Bitcoin Income and Growth Fund- A professionally risk-managed Bitcoin fund product designed to transform BTC volatility into stable yield

Real Asset Fund

Trezor Whiskey 2020 Digital Fund, the world’s first tokenized whiskey barrel fund that captures value appreciation associated with the aging of Kentucky whiskey, designed to be recession resistant

Active VC Fund

Wealth Management

Your ultimate solution for digital asset portfolio management, combining custody, execution, and tailored investment strategies

Protocol Inventory Management

Why us

A Registered Investment Advisor for Digital Assets

As a SEC registered Investment Advisor, we have a fiduciary duty to our clients. Unlike some other providers of crypto investment services, we are legally obligated to protect your interests, and your interests alone. As one of the first Registered Investment Advisors to focus exclusively on digital assets, we provide unparalleled portfolio management developed through years of experience.

A proven track record

Our management team has top-tier experience in investment banking, asset management and global capital markets. We combine financial innovation with regulatory and compliance best practices, so you’re always covered.

Impressive Research-Based Returns

World-Class Custody

Trezor utilizes institutional grade qualified custodian services, helping investors to navigate the complex landscape of digital assets with a connected, compliant, and secure suite of solutions + best in class service providers.

Manage your portfolio

Connect all your exchanges accounts and manage them with our trading terminal. Free of charge!

Trailing features

Follow the price movement and sell/buy automatically when the price goes in another direction.

Trading Bots

Copy other traders easily, or trade automatically with our unique trading A.I.

Pro Tools

Use tools like DCA, Market-Making, Arbitrage or our own free of charge charting software.

Use expert tools without coding skills

Easy. Effective. World class.

Dollar Cost Averaging

Dollar Cost Averaging allows you to double or triple up on an investment that went sour. By using DCA, you can mitigate any potential bags by bringing down the weighted average price.

Read moreShort selling

Short sell your currencies to mitigate a sudden drop. Track your currencies to the bottom and only buy them back when they show signs of recovery.

Read moreTriggers

Respond to the rise and fall of currencies and make sure that you respond to early signs of bear markets. Create customized actions ranging from notifications to sell orders to ensure your portfolio is safe 24/7.

Read moreOur Team

Our Top Traders

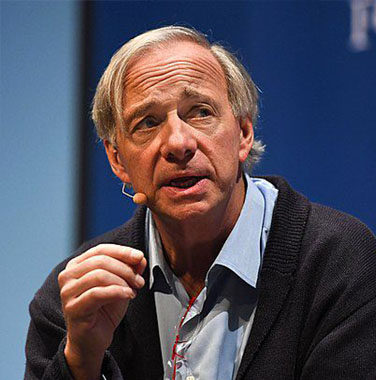

Ray Dalio

Net worth : $19.1 billion

Ray Dalio, a renowned figure in the financial world, began his foray into the markets at the age of 12, when he invested $300 in shares of Northeast Airlines and successfully tripled his investment after the company merged with another entity. After completing his studies at Harvard Business School, he founded the investment company Bridgewater from his modest two-bedroom apartment in New York City in 1975. Through his unwavering commitment and astute business acumen, the company rapidly expanded and experienced tremendous growth in the 1980s, ultimately emerging as the largest hedge fund globally by 2011.

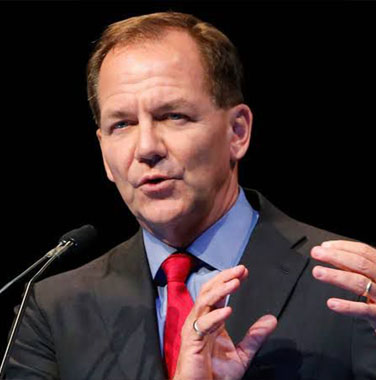

Paul Tudor

Net worth : $7.5 billion

Paul Tudor Jones rose to prominence following his appearance in the PBS documentary "The Trader" in 1987, where he accurately predicted an impending market crash. During the Black Monday crash in the same year, he strategically used stock index futures to triple his capital under management, amassing substantial profits through large short positions. Following the crash, his hedge fund recorded an exceptional 125.9% return in a single day after fees, resulting in an approximate $100 million profit. Over the years, Jones' hedge fund, Tudor Investment Corporation, has consistently delivered steady returns with minimal drawdowns in capital, owing largely to his astute macro trades, particularly his shrewd bets on interest rates and currencies. Jones' success has earned him considerable wealth, and he currently ranks as the 131st richest person globally.

George Soros

Net worth : $6.7 billion

George Soros is a prominent figure in the stock market investment arena, and his success is well-known among both novice and seasoned traders. He famously earned the moniker "The Man Who Broke the Bank of England" due to his remarkable achievement of earning a staggering $1 billion profit in a single day during the 1992 Black Wednesday UK currency crisis. Soros' achievement remains unparalleled, as he is widely regarded as the first individual to have earned such an exceptional amount of money in a single day.

The latest from Trezor Digital Trades

Venture Capitalist with $3 billion in exits, including Macromedia, Launch Media, Myspace, Nevenvision, Pulse, and Cognet

Co-Founder of Blockchain Capital, Tether, Block.One (EOS), Director of Bitcoin Foundation

Founder of Cardano & Co-Founder of Ethereum

Founder of TechCrunch and Arrington Capital

Advisory Board Trezor Digital Trades

We started the industry

FAQ

Holding is not always a good strategy in many market conditions. For instance, when the market is rapidly declining, a bot that sells your assets and repurchases them at a lower price can result in significant gains to your portfolio when the market recovers. Additionally, when the market is flat, a Grid bot can take advantage of daily fluctuations to gradually grow your portfolio over time rather than having your coins in cold storage doing nothing. Ultimately, with careful consideration and proper execution, automated trading can offer traders a valuable tool for maximizing profit potential in the cryptocurrency market.

However, it's worth noting that if you are a resident of a country that is currently on the sanctions list for the European Union, Republic of Estonia, or other nations and international organizations listed under section 26 of our Terms of Use (Client Terms of Use), Trezordigitaltrades is not able to offer you any kind of paid services, which includes our subscription plans. We are committed to complying with all applicable laws and regulations, and unfortunately, this means that we cannot provide services to individuals residing in countries that are subject to sanctions. If you have any questions about our policies or your eligibility for our services, please don't hesitate to reach out to our support team.

Signing up for a paid subscription is typically straightforward and can be done using various payment methods such as credit cards, debit cards, or even cryptocurrencies such as Bitcoin, Ethereum, or other stablecoins and altcoins. Overall, upgrading to a paid plan can offer traders greater flexibility, increased functionality, and ultimately more opportunities to achieve their trading goals in the fast-paced world of cryptocurrency.